Fraud & Risk Monitoring Built for Modern Merchants

Paymetrics delivers merchant fraud prevention and payment fraud monitoring without forcing you to replace your processor or payment stack. Monitor chargebacks, track VAMP ratios, and identify fraud patterns in real time using unified analytics.

Intelligence That Strengthens Merchant Risk Management

Paymetrics operates as a fraud detection and prevention solution that connects directly to your existing processors and gateways.

Instead of switching providers, merchants gain real time payment fraud monitoring and chargeback prevention tools across all transactions.

Protect Transactions With Paymetrics

Paymetrics centralizes fraud prevention analytics, chargeback data, and risk indicators into a single monitoring layer. Merchants gain immediate visibility into payment behavior, VAMP ratio movement, and fraud trends that directly impact approvals and account standing. This approach allows teams to identify risk early, respond faster, and maintain compliance without adding operational complexity.

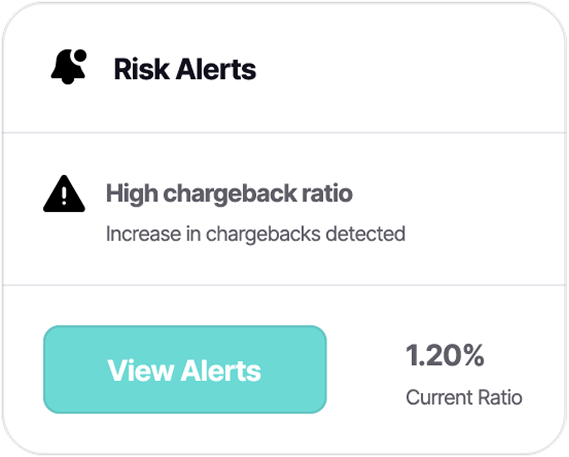

Real Time Chargeback Alerts

Chargeback prevention starts with speed. Paymetrics delivers instant alerts when disputes occur, allowing teams to act before ratios escalate or penalties apply.

VAMP Ratio Tracking

VAMP ratios directly influence processor risk decisions. Paymetrics tracks ratio changes daily, surfaces thresholds, and provides clarity into how disputes affect merchant standing.

Fraud Prevention Analytics

Fraud detection requires patterns, not guesswork. Paymetrics analyzes transaction behavior, dispute history, and approval outcomes to identify high risk activity before losses occur.

Merchant Fraud Prevention and Payment Fraud Monitoring Explained

Merchant fraud prevention relies on identifying suspicious activity before it becomes financial loss. Payment fraud monitoring systems analyze transaction data in real time to detect anomalies such as velocity spikes, repeated authorization failures, and abnormal geographic behavior.

What is payment fraud monitoring

Payment fraud monitoring is the process of continuously reviewing card transactions to detect unauthorized or high risk behavior. This includes monitoring chargeback volume, dispute reasons, and authorization outcomes across all payment channels.

How chargeback prevention tools reduce risk

Chargeback prevention tools reduce losses by identifying disputes early and flagging transaction patterns that lead to fraud claims. Effective tools focus on chargeback frequency by card type and issuer, reason code concentration such as fraud or no authorization, and dispute timing relative to transaction approval.

Why merchant risk management depends on analytics

Merchant risk management requires accurate data to avoid account restrictions. Risk platforms that combine fraud detection and prevention solutions with real time monitoring allow merchants to detect fraud trends within minutes, track VAMP ratios daily instead of monthly, and reduce false declines by separating fraud from normal customer behavior.

When fraud prevention analytics matter most

Fraud prevention analytics matter most during growth periods. Volume increases amplify small risk issues. Merchants processing thousands of transactions daily need continuous visibility to protect approval rates and processor relationships.

Frequently Asked Questions

Explore More Ways to Optimize

The Paymetrics ecosystem gives you the tools to improve visibility, reduce risk, and take full control of your payments, all from one platform.

Get Started in Minutes

Connecting Paymetrics to your existing processor is quick, seamless, and requires zero downtime.

Connect Your Gateway

Integrate your existing payment processor or gateway using our simple onboarding link, no technical overhaul required.

Activate Optimization

Our AI engine analyzes live transactions, identifies cost-saving and approval-boosting opportunities immediately.

Real-Time Results

View recovered revenue, approval improvements, and cost reductions inside your Paymetrics dashboard.